Canadian Institutes of Health Research Annual Report 2020–21

Contents

- Chair’s Message

- Providing Stewardship and Accountability

- Financial Statement Discussion and Analysis

- Financial Statements

Chair’s Message

Chair of the Governing Council

On behalf of the Governing Council, I am pleased to present the 2020-21 Annual Report of the Canadian Institutes of Health Research (CIHR), the Government of Canada’s health research funding agency.

Canada’s Health Research Response to COVID‑19

The past year presented challenges worldwide. Nonetheless, the Canadian health research community persevered, contributing its exceptional talent to help guide our country forward in the response to the COVID-19 pandemic. With deep expertise spanning the medical and social countermeasures to the pandemic, Canadian health researchers pivoted and responded to crucial evidence needs at home and abroad. CIHR played a critical role in ensuring that researchers were supported in these endeavors over the course of the year.

Building on prior investments in COVID-19 research, in April 2020, CIHR launched its second COVID-19 Rapid Research competition, and the research community rose to the challenge. This investment of over $123.5 million supported 153 grants to accelerate the development, testing, and implementation of measures to mitigate the rapid spread of COVID-19 and its negative consequences on people, communities, and health systems. Of these grants, 22 were funded in partnership with the COVID-19 Immunity Task Force and focused on improving our understanding of COVID-19 immunity in Canada.

As new evidence gaps became apparent throughout the pandemic, CIHR launched additional funding competitions to continue to quickly mobilize the Canadian research community in order to generate new knowledge across a rapidly changing pandemic landscape. In April 2020, CIHR, in collaboration with Health Canada and the Public Health Agency of Canada (PHAC), launched the COVID-19 and Mental Health Initiative to support research on mental health and substance use in the context of the pandemic. This initiative supported 101 research projects and represented a total investment of $13.5 million from CIHR and partners. New knowledge generated through these projects is being shared with policy makers from coast to coast to coast in a timely manner. Further, in response to the devastating outcomes of COVID-19 in Canada’s long-term care homes, CIHR and national and provincial partners, including Healthcare Excellence Canada, launched the Strengthening Pandemic Preparedness in Long-Term Care initiative. This investment of $3.4 million has made it possible for 22 research teams to collaborate with long-term care homes to evaluate the implementation and sustainability of promising practice interventions and policies designed to ultimately improve pandemic preparedness within the long-term care sector. And, through the leadership of its Institute of Indigenous Peoples’ Health, CIHR launched the Indigenous Peoples and COVID-19 Knowledge Synthesis, Evaluation and Assessment Grants Rapid Research competition to support strengths-based, solutions-focused research that is bold, Indigenous community-led, and that addresses the consequences of COVID-19 and informs future preparedness. CIHR also has designed an innovative, iterative series of rolling competitions to target key emerging research priorities and evidence gaps going forward. The first Emerging COVID-19 Research Gaps and Priorities competition was launched on March 3, 2021, informed by extensive consultation process with various stakeholders and federal departments.

The CIHR also provided leadership in knowledge translation. Immediately following the COVID-19 Rapid Research competitions, CIHR launched a series of Virtual Investigator Meetings to provide a platform for funded researchers to discuss barriers or accelerators to their research with relevant Government of Canada departments. CIHR was also able to support federal colleagues in accessing the best available evidence related to specific aspects of the COVID-19 pandemic response through its Best Brains Exchanges (BBE) program, which was adapted to be delivered virtually. CIHR hosted a BBE with the Office of the Chief Public Health Officer of Canada to inform the State of Public Health in Canada 2020 Report, and a BBE, also in collaboration with the PHAC, on transmission routes for COVID-19.

The global scale and scope of this health crisis called upon governments and researchers around the world to collaborate in innovative ways, and CIHR provided global leadership to this effort. This includes becoming a signatory of the WHO Public Statement for Collaboration on COVID-19 Vaccine Development in April 2020. Dr. Charu Kaushic, Scientific Director of CIHR’s Institute of Infection and Immunity, was appointed Chair of the Global Research Collaboration for Infectious Disease Preparedness (GloPID-R) and helped organize the GloPID-R Research Synergies Meeting Series. As well, Dr. Steven Hoffman, Scientific Director of CIHR’s Institute of Population and Public Health, was invited by the United Nations Deputy Secretary-General to lead the process for identifying research priorities that will support an equitable, global socio-economic recovery from COVID-19. The UN Research Roadmap for the COVID-19 Recovery is now available for all to read.

The Strategic Direction and a Vision for a Healthier Future

In February 2021, CIHR proudly released the CIHR Strategic Plan 2021–2031: A Vision for a Healthier Future and the Action Plan for Year 1 (2021-22). The plan sets out a 10-year vision whereby Canadian health researchers, at every career stage, work within an ecosystem that is inclusive, collaborative, and focused on real-world impact. Through the strategy, Canadian health researchers are supported to be global leaders who bring about ground-breaking discoveries and improvements to the health care and health outcomes of Canadians. Following the most extensive consultation process with the health research community in CIHR’s history, the plan identifies five new strategic priorities:

- Advance research excellence in all its diversity;

- Strengthen Canadian health research capacity;

- Accelerate the self-determination of First Nations, Inuit, and Métis Peoples in health research;

- Pursue health equity through research; and

- Integrate evidence in health decisions.

Through focusing on these priorities and their associated strategies, CIHR is confident that Canadian health researchers will be positioned to help improve health equity and bring about better health outcomes for all for generations to come.

CIHR will begin to implement the Strategic Plan by focusing on specific strategic areas identified in the Action Plan for Year 1 (2021-22). Key focus areas over the coming year include a number of strategic actions, such as the furthering of Indigenous Health Research by developing new research initiatives; developing an action plan to enhance international collaboration for CIHR and Canadian health research; and engaging with organizations and members of the research community with lived experience and expertise to co-develop an action plan to address systemic bias, including systemic racism, within the CIHR research funding system. The Action Plan also committed CIHR to conducting a critical review and analysis of CIHR’s approach to funding through its existing funding programs.

During the initial months of the pandemic, CIHR focused its efforts on rapidly adjusting to working within a virtual environment and ensuring that Canadian researchers were supported in their quest to understand and respond to the COVID-19 pandemic. As the pandemic continued, we continued to make extraordinary efforts to ensure our ability to conduct our full mandate of activities within a virtual context. CIHR, with tremendous support from the research community, was able to successfully deliver both the Spring and Fall Project Grant competitions, with no change in the level of funding. CIHR also developed and implemented a plan to resume delivery of funding opportunities to support research across a range of priority areas. For example, the Health Research Training Platform competition was piloted, with a view to supporting the development of integrated training and mentoring environments that will position health research trainees and early-career researchers for career success across the full range of health research areas.

Over the past year, CIHR continued to make progress on its Action Plan: Building a healthier future for First Nations, Inuit and Métis (the Plan), and made progress on the Plan’s goal of ensuring CIHR’s investment in Indigenous Health Research (IHR) reaches a minimum of 4.6% of CIHR’s grants and awards annual budget. In the 2019-2020 fiscal year, investment in IHR increased to 4.0%. Between 2018-19 and 2019-20, this represents an additional $11M, for a total of over $45M. Further, CIHR affirmed its commitment to addressing systemic racism in Canada’ health research funding system and took an important step by launching the first of a series of discussions on the topic. CIHR will listen to racialized and Indigenous communities about the barriers they face in Canada's health research funding system and their perspectives on what can be done to address systemic racism within this setting.

CIHR also continued to collaborate with federal colleagues to advance the evidence-based policy agenda of the Government of Canada. CIHR provided evidence to support the Government of Canada’s responses to the ongoing opioid crisis as well as the legalization of cannabis. CIHR also continued to participate in the implementation of the Pan-Canadian Antimicrobial Resistance Action Plan, Federal Framework on Posttraumatic Stress Disorder and the Dementia Strategy for Canada. CIHR also encouraged researchers and their institutions to be especially vigilant and alert to potential threats with the Government of Canada’s Safeguarding your Research portal.

As mentioned above, the scale and scope of the COVID-19 pandemic called for improved and increased collaboration among stakeholders from around the world and of all research disciplines. With this in mind, CIHR was proud to become a signatory of the World Health Organization’s Joint Statement on Public Disclosure of Results from Clinical Trials. Collaboration and increased coordination has been an area of focus for many years for the federal research funding agencies and the Canada Research Coordinating Committee, chaired by CIHR’s President, Dr. Michael J. Strong, in 2020-21. Over the past year, the federal granting agencies delivered on a broad range of shared commitments, including:

- Delivery of a $79.3 million support package to the research community, including trainees, whose research was impacted or delayed due to COVID-19;

- The release of the Tri-Agency Research Data Management Policy;

- The launch of the Equity, Diversity and Inclusion Institutional Capacity-Building Grant; and

- The creation of the Indigenous Leadership Circle in Research.

A Focus on the Future

The COVID-19 pandemic has demonstrated more than any other event in our lifetime, the importance and impact that health research has on people, our communities, and the world. The Canadian health research community has much to be proud of from this past year. Guided by its new Strategic Plan, CIHR will continue to focus on supporting the best science and ensuring the findings are mobilized to inform policies, practices and programs, which bring better health for all.

I invite you to read the financial details of this report to learn more about the investment that enables CIHR, as the Government of Canada’s health research funding agency, to support new scientific knowledge and enable its translation into improved health and a strengthened Canadian health care system.

Sincerely,

Dr. Jeannie Shoveller

Chair, Governing Council

Providing Stewardship and Accountability

CIHR Governing Council

CIHR reports to Parliament through the Minister of Health. Its Governing Council comprises a group of up to 18 distinguished Canadians who together provide oversight and strategic direction for the organization and evaluate its overall performance.

Jeannie Shoveller

Chair

Vice President

Research & Innovation, IWK Health Centre

Professor

Community Health & Epidemiology, Dalhousie University

Debbie Fischer

Executive-in-Residence

Rotman School of Management

Executive Associate, KPMG

Louise Lemieux-Charles

Professor Emeritus

Institute of Health Policy, Management and Evaluation

Dalla Lana School of Public Health

University of Toronto

Alice B. Aiken

Vice-Chair

Vice President

(Research & Innovation)

Dalhousie University

Dominic Giroux

President and CEO

Health Sciences North and the Health Sciences North Research Institute

Stephen Lucas

(Ex-officio, non-voting member)

Deputy Minister

Health Canada

Paul Allison

Faculty of Dentistry

McGill University

Diane Gosselin

President and Chief Executive Officer

CQDM

Amélie Quesnel-Vallée

Professor

Departments of Sociology & Epidemiology

McGill University

Brenda Andrews

University Professor

Donnelly Centre for Cellular and

Biomolecular Research

Department of Molecular Genetics

University of Toronto

Nada Jabado

Senior Scientist

RI‑MUHC Glen site

Child Health and Human Development Program

Michael Salter

Chief of Research and

Senior Scientist

Neurosciences and Mental Health

The Hospital for Sick Children

Mark S. Dockstator

Associate Professor

Trent University

Chanie Wenjack School of Indigenous Studies

Brianne Kent

Assistant Professor

Simon Fraser University

Michael Strong

(Ex-officio, non-voting member)

President, CIHR

Don Ferguson

Former Deputy Minister of Health for New Brunswick

Josette-Renée Landry

CEO, Institut du Savoir, Montfort and

Founder, Streamline Genomics

Marcello Tonelli

Senior Associate Dean

(Health Research)

Cumming School of Medicine

Associate Vice President

(Health Research)

University of Calgary

Financial Statement Discussion and Analysis

Introduction

The following Financial Statement Discussion and Analysis (FSD&A) should be read in conjunction with the Canadian Institutes of Health Research (CIHR) audited financial statements and accompanying notes for the year ended March 31, 2021.

The responsibility for the integrity and objectivity of the FSD&A rests with the management of CIHR. The purpose of the FSD&A is to highlight information and provide explanations to enhance the user’s understanding of CIHR’s financial position and results of operations, while demonstrating CIHR’s accountability for its resources. Additional information on CIHR’s performance is available in the CIHR Departmental Results Report, and information on its plans and priorities is available in the CIHR Department Plan.

Overview

The Canadian Institutes of Health Research was established in June 2000 under the Canadian Institutes of Health Research Act. It is listed in Schedule II to the Financial Administration Act as a departmental corporation. CIHR’s objective is to excel, according to international standards of scientific excellence, in the creation of new knowledge, and its translation into improved health, more effective health services and products, and a strengthened Canadian health care system.

CIHR’s budget is allocated through authorities approved by Parliament. CIHR has separate voted authorities for operating expenses and for grants/awards. Authorities provided to CIHR by Parliament do not parallel financial reporting according to Canadian public sector accounting standards, since authorities are primarily based on cash accounting principles. Consequently, items recognized in the Statement of Financial Position, the Statement of Operations and Departmental Net Financial Position, the Statement of Change in Departmental Net Debt, and the Statement of Cash Flows are not necessarily the same as those provided through authorities from Parliament. Note 3 of the Financial Statements provides users with a reconciliation between the two bases of reporting.

Highlights

CIHR’s financial results in 2020-21 are consistent with those of the preceding fiscal year, taking into account increases in parliamentary authorities available.

1. Statement of Financial Position

| As at March 31 | 2021 | 2020 (unaudited) | % change |

|---|---|---|---|

| Total liabilities | $14.1 | $13.9 | 1.4% |

| Total financial and non-financial assets | $15.3 | $18.3 | (16.3)% |

The slight increase in total liabilities of $0.2 million is primarily due to an increase in the employee vacation accrual ($1.4 million) as a result of increased salary rates and the carrying over of excess vacation leave from year to year. This increase is offset by a decrease in accounts payable and accrued liabilities ($1.2 million) which mainly relates to payables due to other government departments.

The balance in total financial and non-financial assets decreased by $3.0 million over the prior year. This is primarily due to a decrease ($1.5 million) in accounts receivable, largely attributed to a decrease in amounts owing from other government departments. There is also a decrease ($1.2 million) in the amount due from the consolidated revenue fund. The remaining decrease of $0.3 million is due to a decrease in net tangible capital assets ($0.5 million), offset by an increase of $0.2 million in prepaid expenses related to IT contracts.

2. Statement of Operations and Departmental Net Financial Position

| For the year ended March 31 | 2021 | 2020 | % change |

|---|---|---|---|

| Total expenses | $1,517.3 | $ 1,214.8 | 24.9% |

| Net cost of operations before government funding and transfers | $ 1,511.0 | $ 1,208.2 | 25.0% |

The increase in both total expenses (24.9%) and in net cost of operations before government funding and transfers (25.0%) are mainly attributable to Parliamentary authorities provided to CIHR by the Government of Canada which increased by $418.5 million from the prior fiscal year. The increase is primarily due to the COVID-19 funding that CIHR received and distributed during the year.

3. Variance Analysis

3.1 Variances between current year actual results and budget

As noted, CIHR is funded by the Government of Canada through Parliamentary authorities. CIHR’s 2020-21 year-end Parliamentary authorities of $1,624.2 million represent an increase of $418.5 million (or 34.7%) compared to CIHR’s year-end authorities in 2019-20 ($1,205.7 million).

This increase is a key factor to note when comparing current year and prior year results for CIHR. The main reason for the current year increase is due to increased grant funding for COVID-19 research.

| 2020-21 Main Estimates (in millions of dollars) | $1,214.9 |

|---|---|

| Funding for COVID-19 medical countermeasures | 144.2 |

| Funding for a pandemic response and health emergencies research plan | 114.8 |

| Funding to support students and youth impacted by COVID-19 | 87.5 |

| Funding for emergency research and innovation response measures (COVID-19 Rapid Research program) | 25.8 |

| Funding to help mitigate health, social and economic risks of the COVID-19 outbreak | 12.5 |

| Funding to support COVID-19 Immunity Task Force projects | 12.4 |

| Funding for federal investments in testing, contact tracing and data management (Safe Restart agreement) | 1.2 |

| Net transfers from other government departments | 7.0 |

| Compensation adjustments from the Treasury Board Secretariat | 2.7 |

| 2020-21 Operating budget carry-forward | 1.2 |

| Total increase in Parliamentary authorities | 409.3 |

| 2020-21 Year-end Parliamentary authorities | $1,624.2 |

3.2 Variances between current year actual results and prior year actual results

| For the year ended March 31 | 2021 | 2020 (unaudited) | % change |

|---|---|---|---|

| Grants and awards | $1,443.8 | $ 1,136.5 | 27.0 % |

| Operating expenses | $73.5 | $ 78.3 | (6.1) % |

Grants and awards expenses increased by 27.0% (or $307.3 million) in 2020-21 due to increased Parliamentary authorities provided to CIHR for grants (as outlined in section 3.1). Total operating expenses also decreased by 6.1% ($4.8 million) over the previous year. This decrease was mainly due to a cessation of travel in 2020-21 as a result of the pandemic ($4.3 million). There was also a decrease of $1.9 in professional services expenditures (comprised of a decrease in hospitality ($0.6 million) as peer review meetings went virtual due to the pandemic, as well as a number of non-recurring contracts that were specific to fiscal 2019-20 ($1.2M)). Amortization also decreased by $1.0. These decreases were offset by an increase of $2.4 million in salaries and employment benefits due to an economic increase of 1.5%.

4. Trend Analysis

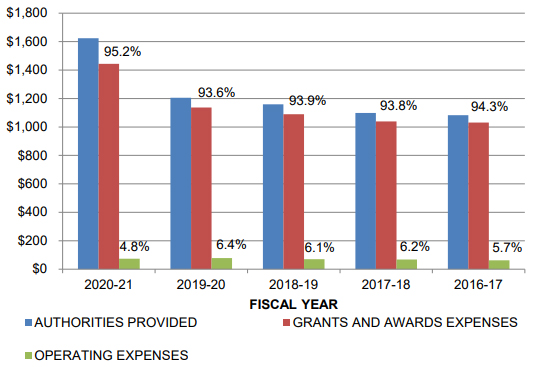

4.1. 4.1 Grants and Awards Expenses

(in millions of dollars)

Grants and Awards Expenses – Long Description

| 2020–21 | 2019–20 | 2018–19 | 2017–18 | 2016–17 | |

|---|---|---|---|---|---|

| Authorities provided | $1,624.2 | $1,205.7 | $1,158.9 | $1,098.4 | $1,083.2 |

| Grants and awards expenses | $1,443.8 | $1,136.5 | $1,088.9 | $1,038.8 | $1,031.1 |

| Operating expenses | $73.5 | $78.3 | $70.5 | $68.5 | $62.1 |

| Percentage grants and awards | 95.2% | 93.6% | 93.9% | 93.8% | 94.3% |

| Percentage operating expenses | 4.8% | 6.4% | 6.1% | 6.2% | 5.7% |

- The proportion of grants and awards expenses in relation to changes in the Parliamentary authorities fluctuate minimally from year to year.

- In 2020-21, grants and awards expenses made up 95.2% of total expenses, as compared to 93.6% in 2019-20.

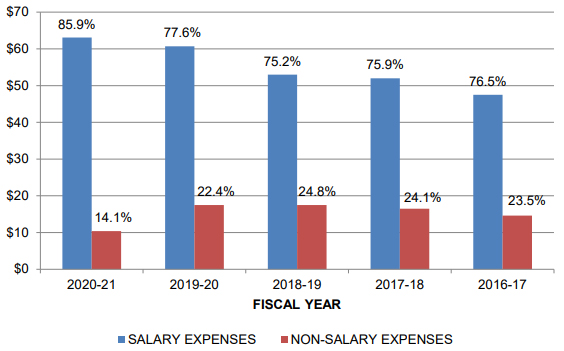

4.2. Operating Expenses

(in millions of dollars)

Operating Expenses – Long Description

| 2020-21 | 2019–20 | 2018–19 | 2017–18 | 2016–17 | |

|---|---|---|---|---|---|

| Salary expenses | $63.1 | $60.7 | $53.0 | $52.0 | $47.5 |

| Non-salary expenses | $10.4 | $17.5 | $17.5 | $16.5 | $14.6 |

| Total | 73.5 | 78.2 | 70.5 | 68.5 | 62.1 |

| Percentage salary expenses | 85.9% | 77.6% | 75.2% | 75.9% | 76.5% |

| Percentage non-salary expenses | 14.1% | 22.4% | 24.8% | 24.1% | 23.5% |

- The ratio of operating expenses to total expenses was 4.8% in 2020-21, as compared to 6.4% in 2019-20.

- Salary and employee benefit expenses increased by $2.4 million (or 4.0%) in 2020-21, as discussed in 3.2.

- In 2020-21, salaries and employee benefits made up 85.9% of total operating expenses, as compared to 77.6% in the prior year.

Financial Outlook – 2021-22

CIHR continues to hold a pivotal role in the response against Covid-19, and is recognized for its ability to mobilize quickly and disburse a significant amount of new funding to support the research community. CIHR continues to deliver COVID-19 funding opportunities, drive Government of Canada priorities, and support the research community in 2021-22.

Building on existing research initiatives, previous year budget announcements continue to influence research investment decisions. CIHR’s commitments to raise investments for graduate students as well as improve equity, diversity and inclusion in the research system remain essential goals for the Agency.

Budget 2021 announced new funding for CIHR related to clinical trials, women’s health, pediatric cancer and mental health.

Canadian scientists are among the best in the world at conducting high-quality clinical trials. Clinical trials lead to the development of new scientifically proven treatments and cures, and improved health outcomes for Canadians. They also create jobs in the health research sector. Accordingly, Budget 2021 proposes to provide $250 million over three years starting in 2021-22 to CIHR to implement a new Clinical Trials Fund.

To advance a coordinated research program that addresses under-researched and high-priority areas of women’s health and ensure new evidence improves women’s care and health outcomes, Budget 2021 proposes to provide $20 million over five years, starting in 2021-22, to CIHR to support the creation of a new National Institute for Women’s Health Research. This new institute will also ensure an intersectional approach to research and care to tackle persistent gaps for all women, including for racialized women, Black and Indigenous women, women with disabilities and members of LGBTQ2 communities.

Cancer is a leading cause of disease-related death in Canadian children. More targeted research is needed to help save lives and improve the services that children and their families receive. To this end, Budget 2021, proposes to invest $30 million over two years, starting in 2021-22, to CIHR to fund pediatric cancer research that can lead to better outcomes and healthier lives for children.

Mental health was an emerging health concern even before the pandemic began with almost one in ten Canadians reporting their mental health care needs are not met. A set of clear national standards is needed so that Canadians can access timely care, treatment and support. As such, Budget 2021 provides $45 million over two years, starting in 2021-22, to CIHR, Health Canada and the Public Health Agency of Canada to develop national mental health services standards.

With ongoing federal funding to create a Centre for Pandemic Preparedness and Health Emergencies, CIHR will be well positioned to coordinate health research investments in prevention, preparedness, response and recovery to ensure that the health research system delivers the evidence that matters most, before, during and after health emergencies.

Financial Statements

Canadian Institutes of Health Research

Statement of Management Responsibility Including Internal Control over Financial Reporting

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2021, and all information contained in these financial statements rests with the management of the Canadian Institutes of Health Research (CIHR). These financial statements have been prepared by management using the Government of Canada’s accounting policies, which are based on Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management's best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of CIHR’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in CIHR’s Departmental Results Report, is consistent with these financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR) designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training and development of qualified staff; through organizational arrangements that provide appropriate divisions of responsibility; through communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout CIHR; and through conducting an annual risk-based assessment of the effectiveness of the system of ICFR.

The system of ICFR is designed to mitigate risks to a reasonable level based on an ongoing process to identify key risks, to assess effectiveness of associated key controls, and to make any necessary adjustments.

A risk-based assessment of the system of ICFR for the year ended March 31, 2021 was completed in accordance with the Treasury Board Policy on Financial Management and the results and action plans are summarized in the annexFootnote 1.

The effectiveness and adequacy of CIHR’s system of internal control is reviewed by of internal audit staff who conduct periodic audits of different areas of CIHR’s operations, and by CIHR’s Audit Committee, which oversees management’s responsibilities for maintaining adequate control systems and the quality of financial reporting, and which recommends the financial statements to the President of CIHR and its Governing Council.

Ernst & Young LLP, the independent auditor for CIHR, has expressed an opinion on the fair presentation of the financial statements of CIHR which does not include an audit opinion on the annual assessment of the effectiveness of CIHR’s internal controls over financial reporting.

Approved by:

Michael J. Strong, MD, FRCPC, FAAN, FCAHS

President

Dalia Morcos Fraser, CPA, CMA

Chief Financial Officer

Ottawa, Canada

July 9, 2021

Independent auditor’s report

To the Members of the Governing Council of the

Canadian Institutes of Health Research

Opinion

We have audited the financial statements of the Canadian Institutes of Health Research [the “Organization”], which comprise the statement of financial position as at March 31, 2021, and the statement of operations and departmental net financial position, statement of change in departmental net debt, and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Organization as at March 31, 2021, and its results of operations and its cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Basis for opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of our report. We are independent of the Organization in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Other matter – comparative information

The financial statements of the Organization for the year ended March 31, 2020 were unaudited.

Responsibilities of management and those charged with governance for the financial statements

,Management is responsible for the preparation and fair presentation of the financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Organization’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Organization or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Organization’s financial reporting process.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Organization’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Organization’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Organization to cease to continue as a going concern.

- Evaluate the overall presentation, structure, and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Ernst & Young LLP

Chartered Professional Accountants

Licensed Public Accountants

Ottawa, Canada

July 9, 2021

Canadian Institutes of Health Research

Statement of Financial Position

As at March 31

(in thousands of dollars)

| 2021 | 2020 (unaudited) |

|

|---|---|---|

| Liabilities | ||

| Accounts payable and accrued liabilities (note 4) | $6,175 | $7,356 |

| Vacation pay and compensatory leave | 5,505 | 4,010 |

| Deferred revenue (note 5) | 1,755 | 1,797 |

| Employee future benefits (note 6) | 666 | 720 |

| Total liabilities | 14,101 | 13,883 |

| Financial assets | ||

| Due from Consolidated Revenue Fund | 7,930 | 9,153 |

| Accounts receivable (note 7) | 2,056 | 3,559 |

| Total financial assets | 9,986 | 12,712 |

| Departmental net debt | 4,115 | 1,171 |

| Non-financial assets | ||

| Prepaid expenses | 605 | 382 |

| Tangible capital assets (note 8) | 4,707 | 5,254 |

| Total non-financial assets | 5,312 | 5,636 |

| Departmental net financial position | $1,197 | $4,465 |

|

Contractual obligations (note 9) |

||

Approved by:

Michael J. Strong, MD, FRCPC, FAAN, FCAHS

President

Jeannie Shoveller, BSc, MA, PhD, FCAHS

Chair, Governing Council

Ottawa, Canada

July 9, 2021

Canadian Institutes of Health Research

Statement of Operations and Departmental Net Financial Position

For the year ended March 31

(in thousands of dollars)

| 2021 | 2021 | 2020 (unaudited) |

|

|---|---|---|---|

| Planned Results (note 2) |

|||

| Expenses | |||

| Funding health research and training | $1,387,719 | $1,479,063 | $1,174,893 |

| Internal Services | 39,627 | 38,219 | 39,886 |

| Total expenses | 1,427,346 | 1,517,282 | 1,214,779 |

| Revenues | |||

| Funding health research and training | 2,372 | 6,300 | 6,542 |

| Total revenues | 2,372 | 6,300 | 6,542 |

| Net cost of operations before government funding and transfers | $1,424,974 | $1,510,982 | $1,208,237 |

| Government funding and transfers | |||

| Net cash provided by Government of Canada | $1,500,904 | $1,199,522 | |

| Change in Due from the Consolidated Revenue Fund | (1,223) | (580) | |

| Services provided without charge by other government departments (note 11) | 8,033 | 8,226 | |

| Net cost of operations after government funding and transfers | 3,268 | 1,069 | |

| Departmental net financial position – beginning of year | 4,465 | 5,534 | |

| Departmental net financial position – end of year | $1,197 | $4,465 | |

|

Segmented information (note 12) The accompanying notes form an integral part of these financial statements. |

|||

Canadian Institutes of Health Research

Statement of Change in Departmental Net Debt

For the year ended March 31

(in thousands of dollars)

| 2021 | 2020 (unaudited) |

|

|---|---|---|

| Net cost of operations after government funding and transfers | $3,268 | $1,069 |

| Change due to tangible capital assets | ||

| Acquisition of tangible capital assets | 783 | 385 |

| Amortization of tangible capital assets | (1,261) | (2,288) |

| Loss on disposal of capital assets | (69) | - |

| Total change due to tangible capital assets | (547) | (1,903) |

| Change due to prepaid expenses | 223 | 49 |

| Net increase / (decrease) in departmental net debt | 2,944 | (785) |

| Departmental net debt – beginning of year | 1,171 | 1,956 |

| Departmental net debt – end of year | $4,115 | $1,171 |

|

The accompanying notes form an integral part of these financial statements. |

||

Canadian Institutes of Health Research

Statement of Cash Flows

For the Year ended March 31

(in thousands of dollars)

| 2021 | 2020 (unaudited) |

|

|---|---|---|

| Operating activities | ||

| Net cost of operations before government funding and transfers | $1,510,982 | $1,208,237 |

| Non-cash items: | ||

| Amortization of tangible capital assets | (1,261) | (2,288) |

| Services provided without charge by other government departments (note 11) | (8,033) | (8,226) |

| (Loss) on disposal of tangible capital assets | (69) | - |

| Variations in Statement of Financial Position: | ||

| (Decrease)/Increase in accounts receivable | (1,503) | 1,814 |

| Increase in prepaid expenses | 223 | 49 |

| Decrease/(Increase) in accounts payable and accrued liabilities | 1,181 | (445) |

| (Increase) in vacation pay and compensatory leave | (1,495) | (995) |

| Decrease in deferred revenue | 42 | 1,024 |

| Decrease/(Increase) in future employee benefits | 54 | (33) |

| Cash used in operating activities | 1,500,121 | 1,199,137 |

| Capital investing activities | ||

| Acquisitions of tangible capital assets | 783 | 385 |

| Cash used in capital investing activities | 783 | 385 |

| Net cash provided by Government of Canada | $1,500,904 | $1,199,522 |

|

The accompanying notes form an integral part of these financial statements. |

||

Canadian Institutes of Health Research

Notes to the Financial Statements (Unaudited)

As at March 31

(in thousands of dollars)

1. Authority and objectives

The Canadian Institutes of Health Research (CIHR) was established in June 2000 under the Canadian Institutes of Health Research Act, replacing the former Medical Research Council of Canada. It is listed in Schedule II to the Financial Administration Act as a departmental corporation.

CIHR’s objective is to excel, according to international standards of scientific excellence, in the creation of new knowledge, and its translation into improved health, more effective health services and products, and a strengthened Canadian health care system. CIHR’s Core responsibility is: Funding Health Research and Training. CIHR is Canada’s health research investment agency. By funding research excellence, CIHR supports the creation of new knowledge and its translation into improved health for Canadians, more effective health services and products and a strengthened Canadian health care system. This is done by providing grants that fund health research and/or provide career and training support to the current and next generation of researchers.

CIHR’s Core responsibility is achieved based on three Programs:

The first program is Investigator-Initiated Research, which provides funding to conduct research in any area related to health aimed at the discovery and application of knowledge. Funding is provided to researchers and academic organizations to conduct research, translate knowledge, and build capacity through research training and salaries. Applicants identify and propose the nature and scope of the research and compete for support by demonstrating excellence and the potential impact the research will have on health systems and/or health outcomes.

The second program is Training and Career Support, which provides award funding directly to promising current and next generation researchers to support training or career development. Applicants at different career stages compete through a rigorous process and those with the highest potential for promising research careers are funded.

The third program is Research in Priority Areas, which provides funding for targeted grants and awards aimed at addressing priority areas. Priorities are identified by CIHR in consultation with other government departments and agencies, partners and stakeholders. The program mobilizes researchers, patients, health providers, and decision makers to conduct research, enable knowledge translation and build capacity in the priority areas. It often requires collaboration within and across sectors.

CIHR is governed by a Governing Council of up to 18 members appointed by the Governor in Council. There are 16 members, including the Chair, that are voting members and, two that are non-voting, ex officio members: the Deputy Minister and the President of CIHR.The Governing Council sets overall strategic direction, goals and policies and oversees programming, ethics, budget and planning.

CIHR has 13 institutes that focus on identifying the research needs and priorities for specific health areas, or for specific populations, then developing strategic initiatives to address those needs. Each institute is led by a Scientific Director who is guided by an Institute Advisory Board, which strives to include representation of the public, researcher communities, research funders, health professionals, health policy specialists and other users of research results.

CIHR’s grants, awards and operating expenditures are funded by budgetary authorities. Employee benefits are funded by statutory authorities.

2. Summary of significant accounting policies

These financial statements are prepared using CIHR’s accounting policies stated below, which are based on Canadian public sector accounting standards. The presentation and results using the stated accounting policies do not result in any significant differences from Canadian public sector accounting standards.

Significant accounting policies are as follows:

Parliamentary authorities

CIHR is financed by the Government of Canada through Parliamentary authorities. Financial reporting of authorities provided to CIHR do not parallel financial reporting according to generally accepted accounting principles since authorities are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and Departmental Net Financial Position and in the Statement of Financial Position are not necessarily the same as those provided through authorities from Parliament. Note 3 provides a reconciliation between the bases of reporting. The planned results amounts in the “Expenses” and “Revenues” sections of the Statement of Operations and Departmental Net Financial Position are the amounts reported in the Future-oriented Statement of Operations (unaudited) included in the 2021-22 Departmental Plan. Planned results are not presented in the “Government funding and transfers” section of the Statement of Operations and Departmental Net Financial Position and in the Statement of Change in Departmental Net Debt because these amounts were not included in the 2021-22 Departmental Plan.

Net cash provided by Government

CIHR operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by CIHR is deposited to the CRF and all cash disbursements made by CIHR are paid from the CRF. The net cash provided by Government is the difference between all cash receipts and all cash disbursements, including transactions between departments of the Government.

Amounts due from the Consolidated Revenue Fund (CRF)

Amounts due from CRF are the result of timing differences at year-end between when a transaction affects authorities and when it is processed through the CRF. Amounts due from the CRF represent the net amount of cash that CIHR is entitled to draw from the CRF without further authorities to discharge its liabilities.

Revenues

Funds received from external parties for specified purposes are recorded upon receipt as deferred revenue. Revenues are then recognized in the period in which the related expenses are incurred.

Deferred revenue consists of amounts received in advance of the delivery of goods and rendering of services that will be recognized as revenue in a subsequent fiscal year as it is earned.

Other revenues are recognized in the period the event giving rise to the revenues occurred.

Refunds of previous years' expenses

These amounts include the return of grants and awards funds to CIHR in the current fiscal year for expenses incurred in previous fiscal years due to cancellations, refunds of previous years' expenses related to goods or services, and adjustments of previous years' accounts payable. These refunds and adjustments are recorded as revenue in the year received.

Expenses

Grants and awards (transfer payments) are recorded as an expense in the year the transfer is authorized and all eligibility criteria have been met by the recipient.

Vacation pay and compensatory leave are accrued as the benefits are earned by employees under their respective terms of employment.

Services provided without charge by other government departments for accommodation and employer contributions to the health and dental insurance plans are recorded as operating expenses at their carrying value.

Employee future benefits

- Pension benefits: Eligible employees participate in the Public Service Pension Plan (the Plan), a multiemployer defined benefit pension plan administered by the Government. CIHR’s contributions to the Plan are charged to expenses in the year incurred and represent the total departmental obligation to the Plan. CIHR’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan’s sponsor.

- Severance benefits: The accumulation of severance benefits for voluntary departures ceased for CIHR executive and non-represented employees in 2011. The remaining obligation for employees who did not withdraw benefits is calculated on the retained accumulated weeks of severance at their current rate of pay as at March 31.

Accounts receivable

Accounts receivable are initially recorded at cost. When necessary, an allowance for valuation is recorded to reduce the carrying value of accounts receivables to amounts that approximate their net recoverable value.

Tangible capital assets

The costs of acquiring land, buildings, equipment and other capital property are capitalized as tangible capital assets and, except for land, are amortized to expense over the estimated useful lives of the assets.

Amortization of tangible capital assets is done on a straight-line basis over the estimated useful life of the capital asset as follows:

Asset class Amortization period Informatics hardware 3–5 years Informatics software 3–10 years Office equipment 10 years Vehicles 5 years Assets under construction are not amortized until they become available for use.

Contingent liabilities

Contingent liabilities are potential liabilities which may become actual liabilities when one or more future events occur or fail to occur. If the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, a provision is accrued and an expense recorded to other expenses. If the likelihood is not determinable or an amount cannot be reasonably estimated, the contingency is disclosed in the notes to the financial statements.

Related party transactions

- Inter-entity transactions are transactions between commonly controlled entities. CIHR is a component of the Government of Canada reporting entity and is therefore related to all federal departments, agencies and crown corporations. Inter-entity transactions are recorded on a gross basis and are measured at the carrying amount, except for the following:

- Services provided on a recovery basis are recognized as revenues and expenses on a gross basis and measured at the exchange amount.

- Certain services received on a without charge basis are recorded for departmental financial statements purposes at the carrying amount.

- Related parties include individuals who are members of key management personnel (KMP) or close family members of those individuals and entities controlled by, or under shared control of, a member of KMP or a close family member of that individual. KMP are individuals having the authority and responsibility for planning, directing and controlling the activities of CIHR. Related party transactions, other than inter-entity transactions, are recorded at the exchange value.

- Inter-entity transactions are transactions between commonly controlled entities. CIHR is a component of the Government of Canada reporting entity and is therefore related to all federal departments, agencies and crown corporations. Inter-entity transactions are recorded on a gross basis and are measured at the carrying amount, except for the following:

Measurement uncertainty

The preparation of these financial statements requires management to make estimates and assumptions that affect the reported and disclosed amounts of assets, liabilities, revenues and expenses reported in the financial statements and accompanying notes at March 31. The estimates are based on facts and circumstances, historical experience, general economic conditions and reflect CIHR’s best estimate of the related amount at the end of the reporting period. The most significant items where estimates are l assets. Actual results could significantly differ from those estimated. Management’s estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

3. Parliamentary authorities

CIHR receives most of its funding through annual parliamentary authorities. Items recognized in the Statement of Operations and Departmental Net Financial Position and the Statement of Financial Position in one year may be funded through parliamentary authorities in prior, current or future years. Accordingly, CIHR has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

Reconciliation of net cost of operations to current year authorities used

2021 2020

(unaudited)Net cost of operations before government funding and transfers $1,510,982 $1,208,237 Adjustments for items affecting net cost of operations but not affecting authorities: Amortization of tangible capital assets (1,261) (2,288) Services provided without charge by other government departments (8,033) (8,226) Increase in vacation pay and compensatory leave (1,495) (995) Decrease/(Increase) in employee future benefits 54 (33) Refunds of previous years’ grants and awards 2,019 4,851 Bad debt expense - (16) Loss on disposal of capital assets (69) - Other adjustments 202 30 (8,583) (6,677) Adjustments for items not affecting net cost of operations but affecting authorities: Acquisition of tangible capital assets 783 385 Increase in accounts receivable for salary overpayments 56 57 Increase in prepaid expenses 223 49 1,062 491 Current year authorities used $1,503,461 $1,202,051 Authorities provided and used

2021 2020

(unaudited)Authorities provided: Vote 1 - Operating expenditures $59,765 $61,780 Vote 5 - Grants 1,348,727 1,137,201 Statutory amounts 215,708 6,669 Less: Frozen authorities (111,040) (1,036) Authorities available for future years (2,900) (1,189) Lapsed: Operating (220) - Lapsed: Grants (6,579) (1,374) Current year authorities used $1,503,461 $1,202,051

4. Accounts payable and accrued liabilities

The following table presents details of CIHR's accounts payable and accrued liabilities:

| 2021 | 2020 (unaudited) |

|

|---|---|---|

| Accounts payable - other government departments and agencies | $865 | $1,413 |

| Accounts payable - external parties | 537 | 429 |

| Total accounts payable | 1,402 | 1,842 |

| Accrued liabilities | 4,773 | 5,514 |

| Total accounts payable and accrued liabilities | $6,175 | $7,356 |

5. Deferred revenue

Deferred revenue represents the balance at year-end of unearned revenues stemming from amounts received from external parties that are restricted in order to fund the expenditures related to specific research projects and stemming from amounts received for fees prior to services being performed. Revenue is recognized in the period in which these expenditures are incurred or in which the service is performed. Details of the transactions related to this account are as follows:

| 2021 | 2020 (unaudited) |

|

|---|---|---|

| Opening balance | $1,797 | $2,821 |

| Amounts received | 4,239 | 665 |

| Revenue recognized | (4,281) | (1,689) |

| Closing balance | $1,755 | $1,797 |

6. Employee future benefits

Pension benefits

CIHR’s employees participate in the Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with the Canada/Québec Pension Plans benefits and they are indexed to inflation.

Both the employees and CIHR contribute to the cost of the Plan. Due to the amendment of the Public Service Superannuation Act following the implementation of provisions related to Economic Action Plan 2012, employee contributors have been divided into two groups – Group 1 relates to existing plan members as of December 31, 2012 and Group 2 relates to members joining the Plan as of January 1, 2013. Each group has a distinct contribution rate.

The 2020-21 employer contributions amount to $4,987 ($4,620 in 2019-20). For Group 1 members, the expense represents approximately 1.01 times (1.01 times in 2019-20) the employee contributions and, for Group 2 members, approximately 1.00 times (1.00 times in 2019-20) the employee contributions.

CIHR’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the Consolidated Financial Statements of the Government of Canada, as the Plan’s sponsor.

Severance benefits

Severance benefits provided to CIHR’s employees were previously based on an employee’s eligibility, years of service and salary at termination of employment. However, since 2011 the accumulation of severance benefits for voluntary departures progressively ceased for substantially all employees. Employees subject to these changes were given the option to be paid the full or partial value of benefits earned to date or collect the full or remaining value of benefits upon departure from the public service. By March 31, 2021, all settlements for immediate cash out were completed. Severance benefits are unfunded and, consequently, the outstanding obligation will be paid from future authorities.

The changes in the obligations during the year were as follows:

2021 2020

(unaudited)Accrued benefit obligation - beginning of year $720 $687 Expense for the year 6 84 Benefits paid during the year (60) (51) Accrued benefit obligation - end of year $666 $720

7. Accounts receivable

The following table presents details of CIHR's accounts receivable balances:

| 2021 | 2020 (unaudited) |

|

|---|---|---|

| Accounts receivable - other government departments and agencies | $1,510 | $2,785 |

| Accounts receivable - external parties | 546 | 774 |

| Total accounts receivable | 2,056 | 3,559 |

CIHR has no allowance for doubtful accounts on receivables from all sources.

8. Tangible capital assets

| Cost | Accumulated amortization | Net book value | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Capital asset class | Opening balance | Acquisitions | Disposals and write-offs | Closing balance | Opening balance | Amortization | Disposals and write-offs | Closing balance | 2021 | 2020 (unaudited) |

| Informatics hardware | $1,741 | $434 | $(448) | $1,727 | $1,217 | $232 | $(440) | $1,009 | $718 | $524 |

| Informatics software | 20,865 | 158 | (69) | 20,954 | 17,217 | 1,018 | (42) | 18,193 | 2,761 | 3,648 |

| Office equipment | 128 | 11 | (116) | 23 | 84 | 7 | (82) | 9 | 14 | 44 |

| Vehicles | 30 | - | - | 30 | 6 | 4 | - | 10 | 20 | 24 |

| Assets under construction | 1,014 | 180 | - | 1,194 | - | - | - | - | 1,194 | 1,014 |

| Total | $23,778 | $783 | $(633) | $23,928 | $18,524 | $1,261 | $(564) | $19,221 | $4,707 | $5,254 |

9. Contractual obligations

The nature of CIHR’s programs may result in large multi-year contracts and obligations whereby CIHR will be obligated to make future payments in order to carry out its grants and awards payment programs or when the services/goods are received. Significant contractual obligations that can be reasonably estimated are summarized as follows:

| Grants and awards | Operating expenditures | Total | |

|---|---|---|---|

| 2022 | $971,173 | $1,673 | $972,846 |

| 2023 | 713,367 | 152 | 713,519 |

| 2024 | 472,523 | 107 | 472,630 |

| 2025 | 273,616 | 40 | 273,656 |

| 2026 | 119,706 | - | 119,706 |

| 2027 and subsequent | 27,294 | - | 27,294 |

| Total | $2,577,679 | $1,972 | $2,579,651 |

10. Contingent liabilities

CIHR may be subject to claims and litigation in the normal course of business. In management's view, there are currently no such claims with a material impact on the financial statements and, consequently, no provision has been made.

11. Related party transactions

-

Common services provided without charge by other government departments

During the year, CIHR received services without charge from certain common service organizations related to accommodation and the employer’s contribution to the health and dental insurance plans. These services provided without charge are recorded at the carrying value in CIHR’s Statement of Operations and Departmental Net Financial Position as follows:

2021 2020 (unaudited) Employer's contribution to the health and dental insurance plans $4,375 $4,494 Accomodation 3,658 3,732 Total $8,033 $8,226 The Government has centralized some of its administrative activities for efficiency, cost-effectiveness purposes and economic delivery of programs to the public. As a result, the Government uses central agencies and common service organizations so that one department performs services for all other departments and agencies without charge. The costs of these services, such as the payroll and cheque issuance services provided by Public Services and Procurement Canada, are not included in CIHR’s Statement of Operations and Departmental Net Financial Position.

Administration of programs on behalf of other government departments

Under a memorandum of understanding signed with the Natural Sciences and Engineering Research Council (NSERC) and the Social Sciences and Humanities Research Council (SSHRC), CIHR administers funds for the Vanier Canada Graduate Scholarship and Banting Postdoctoral Fellowship programs. During the year, CIHR incurred expenses of $24,890 ($23,038 in 2019-20) for grants and awards on behalf of NSERC and SSHRC. These expenses are reflected in the financial statements of NSERC and SSHRC and are not recorded in these financial statements.

12. Segmented information

Presentation by segment is based on CIHR’s core responsibilities. The presentation by segment is based on the same accounting policies as described in the Summary of Significant Accounting Policies in note 2. The following table presents the expenses incurred and revenues generated for the main core responsibilities, by major object of expense and by major type of revenue. The segment results for the period are as follows:

| 2021 | 2020 (unaudited) |

|||

|---|---|---|---|---|

| Funding health research and training | Internal Services | Total | Total | |

| Grants and awards | $1,443,791 | $- | $1,443,791 | $1,136,517 |

| Operating expenses | ||||

| Salaries and employee benefits | 32,798 | 30,280 | 63,078 | 60,728 |

| Travel | - | 1 | 1 | 4,246 |

| Professional and special services | 546 | 1,656 | 2,202 | 4,049 |

| Accomodation | 1,861 | 1,797 | 3,658 | 3,732 |

| Amortization of tangible capital assets | - | 1,261 | 1,261 | 2,288 |

| Rentals | 3 | 1,474 | 1,477 | 1,612 |

| Communication | 18 | 596 | 614 | 740 |

| Furniture, equipment and software | 45 | 561 | 606 | 675 |

| Utilities, materials and supplies | 1 | 34 | 35 | 100 |

| Other | - | 559 | 559 | 92 |

| Total operating expenses | 35,272 | 38,219 | 73,491 | 78,262 |

| Total expenses | 1,479,063 | 38,219 | 1,517,282 | 1,214,779 |

| Revenues | ||||

| Refunds of previous years' grants and awards | 2,019 | - | 2,019 | 4,851 |

| Donations for health research | 4,281 | - | 4,281 | 1,691 |

| Total revenues | 6,300 | - | 6,300 | 6,542 |

| Net cost from continuing operations | $1,472,763 | $38,219 | $1,510,982 | $1,208,237 |

13. Comparative information

In response to the outbreak of the Coronavirus disease (COVID-19), the Government of Canada enacted emergency measures to combat the spread of the virus. These measures, which include the implementation of travel bans, quarantine restrictions and physical distancing, have caused material disruption to businesses globally resulting in an economic slowdown.

Like many organizations, CIHR’s operations have been significantly impacted by the COVID-19 pandemic. Since March 2020, when CIHR activated its Business Continuity Plan, all employees have been required to work remotely with very limited and controlled access to CIHR’s office space while also moving all peer review meetings to the virtual model. CIHR has supported employees through this transition with new information technology solutions and access to new or existing office equipment for use in their homes.

The financial impact of the COVID-19 pandemic on CIHR's grant and award and operating budgets has required CIHR to be proactive and nimble in its financial management strategies. As identified as a critical service during the pandemic, CIHR deployed teams across the organization quickly to support the COVID-19 rapid response by adopting an agile governance structure that streamlined decision-making while retaining key protocols and peer-review mechanisms. This revised structure and decision-making framework allowed CIHR to access over $427M of COVID-19 funding to mobilize research in response to the pandemic.

Through the pandemic, CIHR has supported its employees and its research community while quickly funding research in COVID-19 related research such as vaccines and variants.

14. Comparative information

Certain comparative figures have been reclassified to conform to the current year’s presentation.

- Date modified: